Transaction models for digital currencies

#Blockchain #UTXO #DigitalCurrency #Innovation #FinTech

In the discussion about digital currencies, the question of how the traceability of each user’s credit balance can be guaranteed arises time and again. However, not only the traceability of the credit balance, but also the execution of transactions depends heavily on the chosen technical design of a digital currency. In a further step, the chosen design in turn influences the data protection standards on which the system is based. Here too, the more centralized the technical design, the lower the level of data protection. The ECB’s current efforts have not yet produced a conclusive result as to how the digital euro should be technically designed. However, there are initial indications as to which data protection standards the system should be based on.

In this blog post, we want to take a closer look at two options, examine the advantages and disadvantages and classify them. Specifically, we will look at the following 2 models:

- Token-based model

- Account-based model

We then take a look at how the chosen model affects the maximum possible data protection.

Disclaimer: The following comments on data protection relate to the methodological approach and the inherent advantages and assume consistent implementation considering all relevant cyber security aspects. In the following, mainly the dimensions of privacy and traceability are considered.

Token-based model (Focus: UTXO-model)

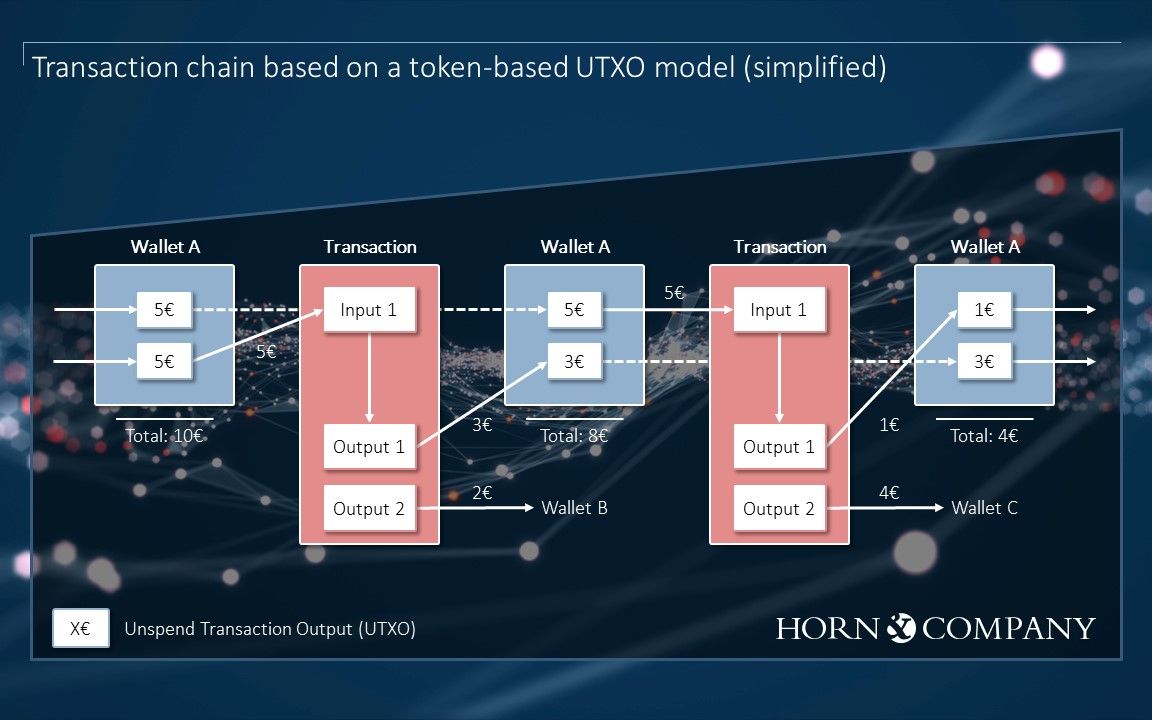

A UTXO (Unspent Transaction Output) model is a fundamental concept of blockchain technology, especially for cryptocurrencies such as Bitcoin. In this model, transactions are divided into two main components: Outputs and Inputs. Each transaction generates new outputs called Unspent Transaction Outputs (UTXOs). These UTXOs represent the balance of a wallet and can later be used as inputs in other transactions.

There are no central accounts in the UTXO model. Each user has a wallet with keys that are assigned to a list of UTXOs. To determine the total balance of a wallet, all assigned UTXOs must be added together. The advantages lie in the increased privacy and anonymity of users, as transactions are more difficult to assign to individual persons. In addition, the use of UTXOs also offers security in terms of liquidity, as each transaction is validated independently to ensure that the sum of the inputs is at least as large as the sum of the outputs. Transactions can therefore only be carried out if a user can cover the expenses. This basic principle helps to protect the network from fraudulent activity.

The special feature of the UTXO model is that a UTXO can only be used once in a transaction. As soon as a UTXO has been used in a transaction, it is no longer available for other transactions. The input UTXOs are “destroyed” and split into one or more new output UTXOs, which are assigned to the individual transaction participants. This is an essential mechanism for preventing double spending and ensuring the integrity of the blockchain.

In simple terms, a UTXO wallet can be thought of as a physical wallet with banknotes and coins and a transaction in the UTXO model as a purchase with cash. The following figure shows a simplified visualization of a transaction chain:

Account-based model

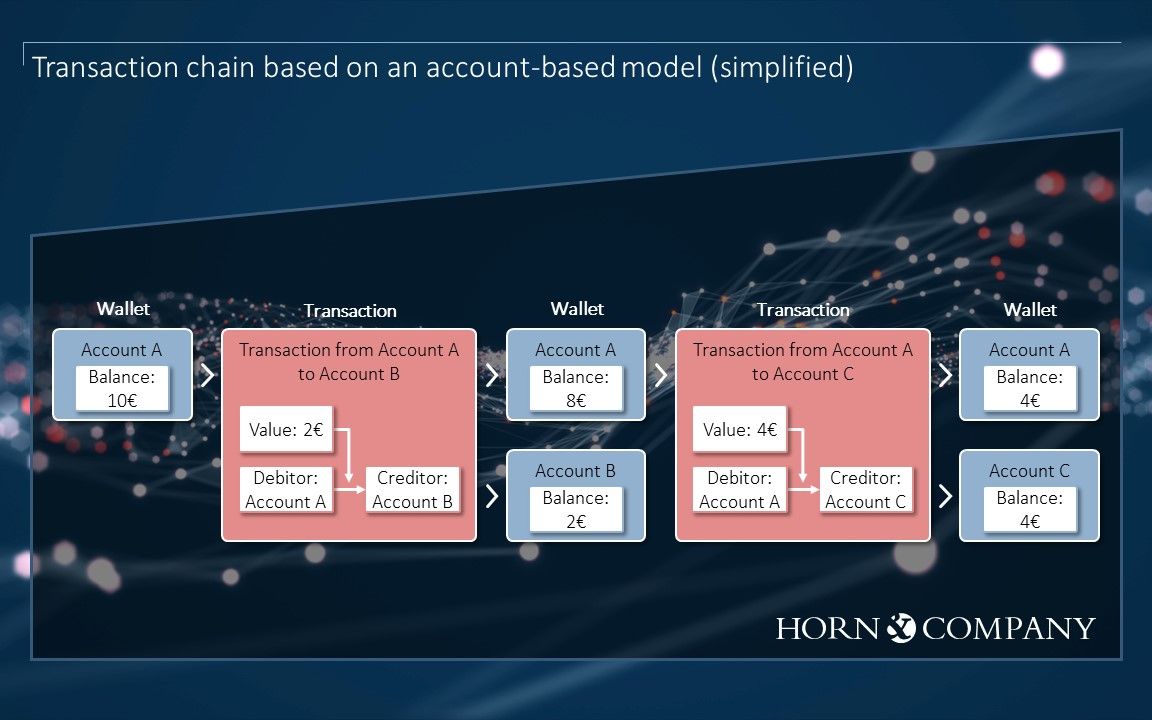

The account model is an alternative method for processing transactions with digital currencies. Here, accounts are used to manage credit balances, similar to a traditional current account. Each user has an account in which their balance is stored. During transactions, the balance is transferred between the accounts. During a transaction, the amount is debited from the sender’s account and transferred to the recipient’s account. In contrast to the UTXO model, the account model does not provide details of specific inputs and outputs. Instead, it focuses on the change in the account balance and is therefore comparable to cash accounts.

A key feature of the account model is its simplicity and ease of use. Users can easily view their entire account balance without having to go through the entire transaction history. However, the anonymity of users is lower compared to the UTXO model, as the accounts contain the entire transaction history and therefore every transaction can be traced. At the same time, it is more difficult to trace the origin of credit balances as, unlike a UTXO, credit balances do not have a “serial number”.

The following illustration shows a simplified representation of a transaction chain:

The account model can be used both traditionally and on a blockchain. However, the distinction plays a subordinate role in this article.

Data protection – A question of design?

A closer look at the two models reveals that the account model is more reliant on additional data protection measures than the UTXO model. A look into an account enables a potential attacker to view all transactions, including the recipient data. Even the anonymization and storage of account holders in anonymized form only marginally improves the situation, as a mapping table or calculation logic from anonymized names to clear names must exist to display the clear names.

A UTXO model with fully decentralized processing has inherent data protection. Although all transactions are visible to an attacker in the blockchain, the generation of individual and random IDs per transaction prevents the traceability of all transactions. UTXOs are validated by the generating transaction, which in turn is validated by the previous transaction – all based on a single UTXO, without assignment to a wallet. At the same time, the random anonymization of the wallet in a transaction means that it is not easy to trace which UTXOs all belong to a wallet. Only the owner of the wallet can find out how much money (=UTXOs) they currently have by making a query. This principle can also be applied to a UTXO model with central validation (e.g. by a bank).

Put simply, the UTXO model, in direct comparison to the account model, breaks down information further (individual transaction vs. entire transaction history) and distributes the information on the blockchain.

BUT: The higher the level of data protection, the less information a bank can obtain from the transaction data. It is therefore always a trade-off between the necessary data protection and the use of the transaction data.

Advantages and disadvantages for the financial industry

Both models have advantages and disadvantages for carrying out transactions. On the one hand, the account model uses the same mechanisms as today’s payment transactions and is therefore more accessible for most people. On the other hand, the UTXO model relies on the new blockchain technology, which offers advantages but is still uncharted territory in the financial world.

For customers, the UTXO model has the advantage that the balance in the wallet is not just a number, but is represented by dedicated tokens. The token offers the end customer the security of ownership of a specific asset (similar to cash in a wallet) to which only they have access. This advantage is in turn a disadvantage for the banks, as the issuing of tokens means that they are no longer able to use this money as part of their money creation process.

If transactions are also to be carried out offline, the UTXO model offers a better starting point. As the transactions are verified and validated by the blockchain, they can also be carried out offline without any additional risk. The copy of the blockchain available offline on the sender and receiver device can be used as the basis for validation. The transaction generates new UTXOs and a new block in the blockchain, which is checked and synchronized as soon as one of the devices reconnects to the network. With an account-based model, there must always be a corresponding risk assessment and assumption that covers the failure of one party. Otherwise, the transaction is subject to a high risk of default.

At the same time, the potential of a UTXO model should not be neglected, as it can lead to enormous efficiency gains for banks and financial service providers. Due to the clear assignability and verification of each transaction by the blockchain, many functions and processes are not required in the operation of an account-based model. As a result, unnecessary operating costs can be saved here.

Conclusion – It’s all a question of vision

Financial companies have the choice between different transaction models if they want to create their own digital currency. It is important to define a vision that serves as the basis for the choice of transaction model. This is because the choice of model not only has an impact on transactions, but also determines how balances are managed or what requirements are placed on wallets or accounts. The inherent data protection also depends on the choice of model, but can be increased or decreased at will through internal company or strategic decisions.

Do you have specific questions about digital currencies and possible transaction models?

Our experts at Horn & Company are available to discuss the implications for your business model. Contact us today to find out about your options in the digital assets and payments environment.

Contact the author

Leon Heyn

E-Mail: leon.heyn@horn-company.de

Contact the author

Dr. Alexander Otterpohl

E-Mail: alexander.otterpohl@horn-company.de

Your gateway to industry knowledge and expert analysis! Follow us on LinkedIn for exclusive professional articles and project insights.