Three Years eWpG: The Impact on the Digital Financial World

#crypto #regulation #eWpG #digitalassets

On June 10, 2024, the Electronic Securities Act (eWpG) celebrates its birthday and turns 3 years old. We are taking this opportunity to congratulate with a short review in which we discuss the impact the eWpG has already had on the digital financial world and what can be expected in the future.

1. Crypto securities – a status review

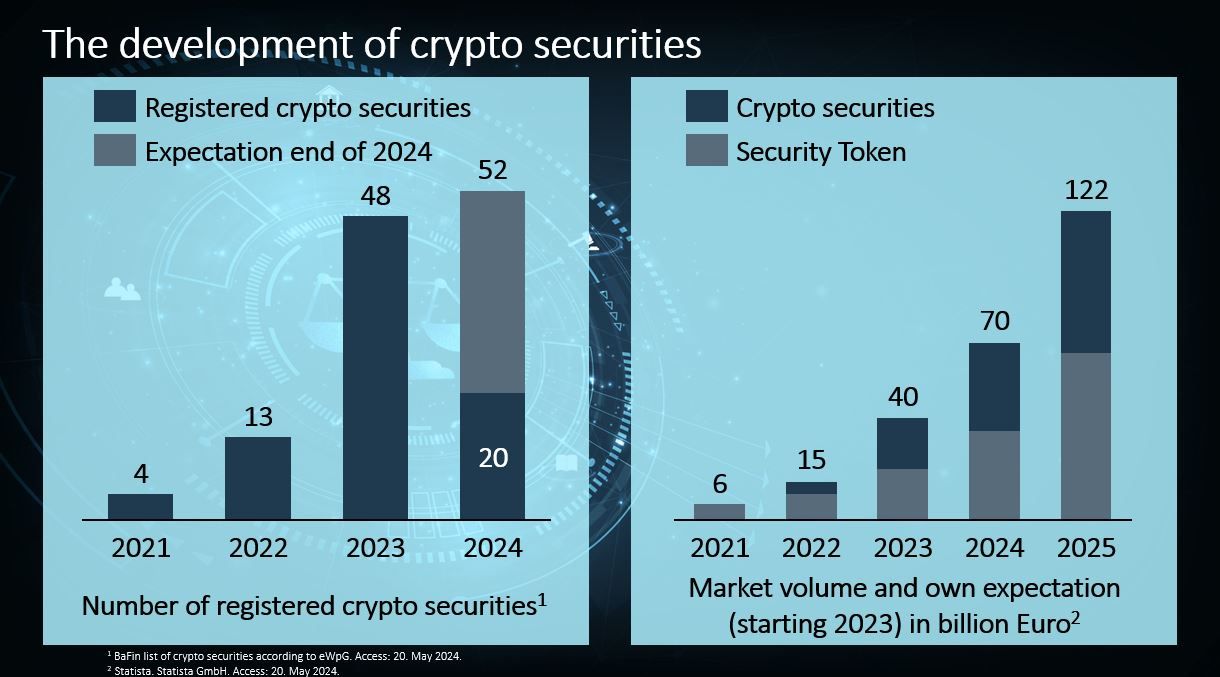

From January to May 2024, 20 crypto securities were issued according to the public crypto securities list published by BaFin in accordance with the eWpG, after a total of 48 crypto securities in 2023.

While there was initially strong growth after the eWpG came into force in 2021 up to and including 2023, a slowdown to 52 issuances (linear extrapolation) in 2024 is currently expected.

One possible reason for the overall low number of issuances and the slowdown in the growth rate could be the exclusion of crypto securities from the recording of securities in book-entry form at a central securities depository, as this is only intended for central register securities with a central securities depository maintaining the register. This means that crypto securities cannot be traded on a stock exchange and can only be traded over the counter (OTC). Interestingly, this restriction was already addressed in the comments on the draft of the eWpG, in which this problem was partially anticipated. In order to meet the growth forecasts, however, further potential must be unlocked.

2. The Electronic securities act

The starting signal for electronic securities was given in 2019 when the German government published its Blockchain strategy. The aim of the strategy is to create a framework for innovations based on Blockchain technology. In June 2021, the Electronic Securities Act (eWpG) completed the shift from the physical form of issuance requiring paper certificates by introducing electronic securities. Even if securities are generally held in collective custody with a central securities depository and ownership is represented by electronic bookings on custody accounts as part of the clearing system, a physical global certificate is still required, which is deposited with the central securities depository. In contrast to that, the registration in an electronic securities register replaces the global certificate in case of electronic securities. Regarding the legal effect, however, both forms of issuance are equivalent. This applies in particular to acquisition in good faith. At first glance, this may appear to be a legal triviality, but it contributes significantly to the fact that electronic securities, unlike ordinary security tokens, create legal certainty for all parties involved.

When they were first introduced, electronic securities were initially limited to bearer bonds. These include, for example, traditional bonds, warrants, commercial papers and certificates. When the Regulation on Crypto Fund Units came into force on June 18, 2022, the scope of the eWpG was extended to fund units. The last and probably most important extension happened at the beginning of 2024 with the Financing for the Future Act (ZuFinG). By means of the ZuFinG, registered shares and bearer shares restricted to central registers were included in the eWpG. This means that a broad spectrum of financial instruments is now covered by the eWpG.

In addition to the previously explained innovation regarding the issuance, the eWpG introduces two forms of electronic securities – central register securities and crypto securities. The classification is based on the underlying electronic securities register in which the issuance is recorded. The two forms address different use cases.

Central register securities can be held in custody by both a central securities depository and a custodian bank authorized by the issuer, each of which maintaining the underlying central register. This change will effectively only affect the German central securities depository Clearstream AG, which has already responded to the eWpG with its new D7 platform for issuing digital securities. The existing process will only change with regard to the physical global certificate, which is no longer required. All other settlement processes and bookings will remain unchanged in the previous electronic form. The eWpG consequently helps advancing the digitalization of securities issuance and transfers one of the last physical necessities – the issuance of a certificate – into the digital age.

The situation is different for crypto securities. Here, the eWpG addresses the actual core of DLT-based digital assets. Crypto securities are issued by registration in a crypto securities register. A crypto securities register must be kept on a forgery-proof recording system in which data is logged in chronological order and stored in such a way that it is protected against unauthorized deletion and subsequent modification. Even if the legislator has chosen a formulation that is open to all technologies, the distributed ledger technology (DLT), with the Blockchain being the most prominent example, is likely to establish itself as the leading solution from today’s perspective. Furthermore, the field of possible entities maintaining the crypto securities register is not limited to central securities depositories and custodian banks. However, maintaining a crypto securities register is a financial service and consequently requires a license from BaFin in accordance with the German Banking Act. In addition to technical requirements for electronic registers in general and crypto securities registers in particular, the eWpG also stipulates that every issuer must fulfill publication obligations in the German Bundesanzeiger. In addition, BaFin must maintain a public list of all crypto securities that were notified. This list provides information on the extent to which crypto securities have arrived in the financial world today, three years after the eWpG came into force.

3. MICAR & electronic securities

From December 30, 2024, the European Markets in Crypto-Assets Regulation (MiCAR) will come into force and regulate digital assets in a new way. Can changes also be expected for electronic securities?

As already explained in one of our previous blog posts, this will not be the case for either central register securities or crypto securities. Crucially, MiCAR will only apply to crypto securities that are not already covered by existing EU regulations. However, as electronic securities under the eWpG have the same legal effect as traditional securities and differ only in the form in which they are issued, they are consequently financial instruments and exempt from MiCAR.

Conclusion

So where do we stand after three years of the eWpG? Regarding the legislator, it should be noted that at least some of the changes initially requested, such as the inclusion of shares, have been implemented. However, problems such as the aforementioned exclusive OTC trading of crypto securities still exist. Certainly, there is still potential for optimization in order to enable standardized trading of crypto securities and to disseminate them more quickly. This thesis is supported by the number of crypto securities issued, whose growth rate appears to be slightly slowing down. New impulses are needed to meet market expectations.

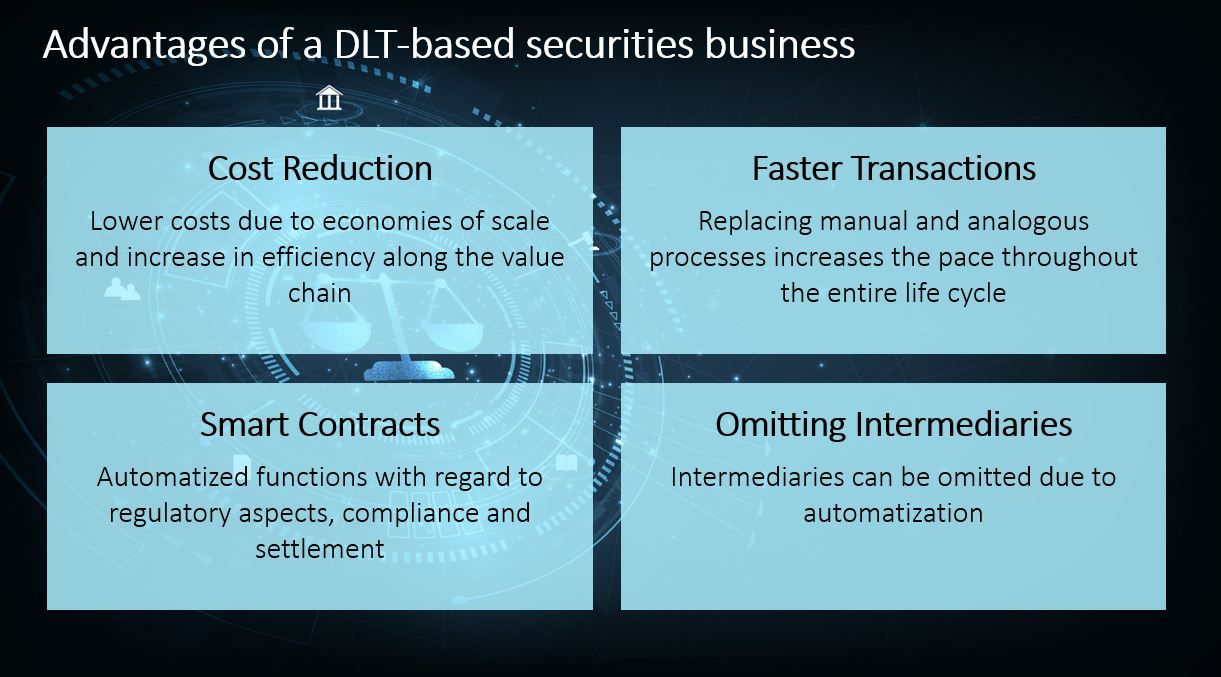

Nevertheless, the introduction of the eWpG was an important and correct step for the German financial center to keep pace with the digital innovations of the global financial world. The advantages of the ongoing digitalization of the securities business are too massive and will deploy their disruptive character rather sooner than later.

This makes it all the more important to prepare for the new possibilities of a DLT-based securities world in time and to review one’s own business model. A successful strategy for the future can only be based on a holistic analysis that takes into account the opportunities, risks and one’s own goals.

Do you have specific questions regarding MiCAR or other regulations?

Our experts at Horn & Company are available to discuss the implications for your business model. Contact us today to find out more about the impact of electronic securities and your opportunities in digital assets.

Contact the author

Dr. Alexander Otterpohl

E-Mail: alexander.otterpohl@horn-company.de

Contact the author

Leon Heyn

E-Mail: leon.heyn@horn-company.de

Your gateway to industry knowledge and expert analysis! Follow us on LinkedIn for exclusive professional articles and project insights.