Entering the Metaverse: Questions for Banks and Financial Companies

#metaverse #strategy #buyorbuilt

The Metaverse is an increasingly relevant trend in the digital world. As discussed in our previous articles, there are various applications for banks and financial companies, broadly categorized into internal use cases for employees (e.g., training, remote work) and external use cases for customers (e.g., remote consulting, events). Banks and financial companies now face the question of whether and how to enter this new dimension. This blog post aims to clarify this question concerning external use cases and examines the pros and cons of both approaches.

SHOULD BANKS AND FINANCIAL COMPANIES ENTER THE METAVERSE?

Before a bank or financial company seriously considers entering the Metaverse, several fundamental questions should be answered:

Is our target audience active in the Metaverse? Before a financial institution ventures into the Metaverse, it should check if its target audience is active there or will be in the near future. Young, tech-savvy customers are particularly relevant here, as they are often the early adopters of new technologies. Market studies and customer surveys can help answer this question.

What benefits do we expect from the Metaverse? There must be a clear benefit. Possible advantages include improved customer loyalty, innovative services, new business opportunities, and increased brand awareness. For instance, a bank could offer virtual consultation appointments in the Metaverse, appealing especially to young and tech-savvy customers.

Do we have the necessary resources and expertise? Entering the Metaverse requires investments in technology, personnel, and training. Banks must ensure they have the necessary resources and knowledge to succeed in this step. This includes both the technological infrastructure and qualified employees who can drive the Metaverse project forward.

How does the Metaverse fit into our long-term strategy? The Metaverse must be integrated into the long-term corporate strategy. It must be clear how entering the Metaverse helps achieve the company’s strategic goals. A thorough analysis is essential to ensure the Metaverse project is not isolated but seen as an integral part of the overall digital transformation strategy.

Once these questions are answered and the decision to enter the Metaverse is made, the next important question arises: Should the bank build its own Metaverse or join an existing one?

Building Own Metaverse vs. Joining an Existing Metaverse

Creating an Own Metaverse

Advantages and Opportunities:

- Value Creation Opportunities through Third-Party Providers: An own Metaverse offers the possibility to rent platform space to third-party providers. For example, a bank could rent virtual branches or consultation rooms to financial advisors or other service providers, creating additional revenue streams. Furthermore, the bank can selectively choose and strategically deploy actors in its Metaverse to support its business goals. This allows for a tailored user experience and targeted interaction with partners and customers.

- Strengthening Brand Loyalty: A unique Metaverse experience can enhance the brand and deepen customer loyalty. Custom designs and exclusive services create a strong emotional connection to the brand. Additionally, an own Metaverse allows the bank to have full control over communication and interaction with the end customer without relying on third-party providers. This can be particularly advantageous in customer support and consulting.

- Proprietary Standards: The bank can develop its own standards and protocols to differentiate itself from the competition and offer a unique user experience. This could include special security protocols or innovative financial services.

- Exclusive Contracts with Partners and Suppliers: Exclusive contracts can exclude competitors and strengthen strategic partnerships. This could mean, for example, that certain financial products are only available in this Metaverse.

Disadvantages and Challenges:

- Mobilizing Resources: Building an own Metaverse requires significant IT, financial, and personnel resources. This involves not only the initial investments but also ongoing costs for operation and development.

- High Initial Investment: The initial investments for developing and operating an own Metaverse can be very high. During the development phase, external service providers are usually brought in to support or completely undertake the Metaverse’s construction. Our experiences show that while development costs depend on the complexity of the project, there are also significant price differences between providers, which should not be underestimated.

- Risk of Not Achieving Desired User Numbers: There is always the risk that despite all efforts and investments, not enough users will adopt the platform, endangering the project’s profitability. Starting from scratch without leveraging the user numbers of an existing Metaverse is a challenge that must be taken seriously.

Joining an Existing Metaverse

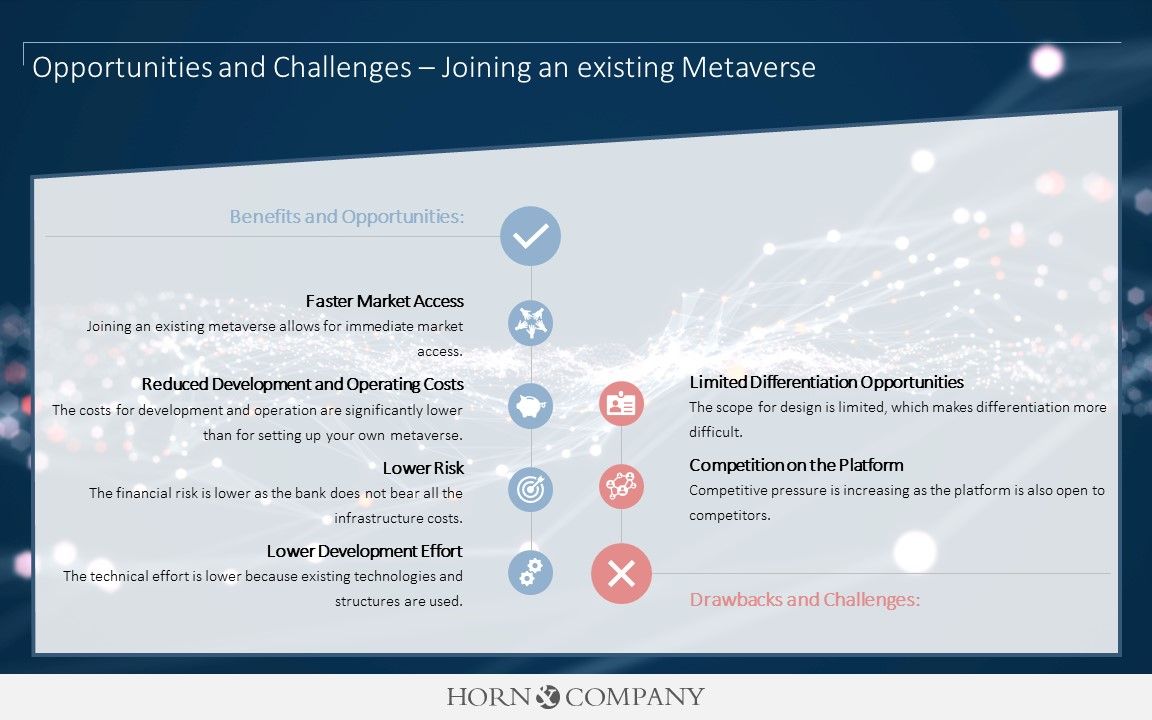

Advantages and Opportunities:

- Faster Market Access: Joining an existing Metaverse allows immediate market access. Banks can immediately leverage the existing infrastructure and offer their services to a wide audience.

- Reduced Development and Operating Costs: The costs for development and operation are significantly lower than building an own platform, making entry into the Metaverse less risky and capital-intensive.

- Lower Risk: The financial risk is lower since the bank does not bear the entire cost and risk of the infrastructure. This makes entering the Metaverse safer and more predictable.

- Lower Development Effort: The technical and organizational effort for entry is lower as the bank can rely on existing structures and technologies of the platform. While external support is also used here, it is not comparable in intensity to building an own Metaverse.

Disadvantages and Challenges:

- Dependency and Limited Differentiation Opportunities: The bank becomes dependent on the platform’s rules and prices, which can limit its room for maneuver. The platform can, for example, increase fees or change usage conditions. The scope for customization is limited, making it difficult to create unique and brand-specific experiences.

- Competition on the Platform: The platform can be opened to other competitors, increasing competitive pressure. This may require the bank to constantly innovate to stand out from the competition.

Conclusion

The decision for a bank or financial company to enter a Metaverse depends on various factors such as the target audience, strategic goals, available resources, and expected cost-benefit ratio. If the decision is made to enter, it is crucial to carefully weigh whether to build an own Metaverse or join an existing one.

An own Metaverse offers full control and the creation of unique experiences but requires significant investments and poses great challenges. Joining an existing Metaverse, on the other hand, allows for a quicker and more cost-effective entry but comes with dependencies and limited differentiation opportunities.

Considering your entry into the Metaverse?

It is clear: a successful entry into the Metaverse requires thorough analysis and clear strategic considerations. Only in this way can banks and financial companies optimally leverage the opportunities of the Metaverse and strengthen their position in the digital space.

Our experts at Horn & Company are happy to personally assist you in discussing your individual potentials and market entry strategy. Contact us today to explore your opportunities in the emerging Metaverse.

Contact the author

Martin Rupprecht

E-Mail: martin.rupprecht@horn-company.de

Contact the author

Leon Heyn

E-Mail: leon.heyn@horn-company.de

Your gateway to industry knowledge and expert analysis! Follow us on LinkedIn for exclusive professional articles and project insights.